Link Login Slot Deposit Pulsa

Slot Gacor

Slot Gacor

Slot Gacor

Slot Gacor

Slot Gacor

Portal News

Slot Dana

Slot Dana

Miyomar1337 News » Karena Informasi Adalah Kekuatan

Berita

news

slot gacor

Berita

dudik

Slot Gacor

Toto Slot

Noel Immanuel Ebenezer Bawa Berkah Cuan Besar di Mahjong Ways

Eksklusif Immanuel Ebenezer Main Mahjong Ways dan Raih Cuan Fantastis

Cerita Noel Immanuel Ebenezer Hasilkan Cuan Tak Terduga dari Mahjong Ways

Rahasia Cuan Besar ala Immanuel Ebenezer Lewat Mahjong Ways

Noel Main Mahjong Ways Immanuel Ebenezer Buktikan Cuan Bisa Gampang

Limited Edition Immanuel Ebenezer Tunjukkan Cara Cuan Besar di Mahjong Ways

Noel Immanuel Ebenezer Trending Berkat Cuan Spektakuler Mahjong Ways

Eksperimen Noel Immanuel Ebenezer di Mahjong Ways Hasilnya Mengejutkan

Cuan Hebat Ala Noel Immanuel Ebenezer Saat Main Mahjong Ways

Immanuel Ebenezer Viral Mahjong Ways Jadi Sumber Cuan Berlimpah

Mahjong Ways Sensasi Baru Usai Demo DPR Raih Kemenangan Limited Edition

Cara Seru Habis Demo Main Mahjong Ways Dapatkan Bonus Besar-Besaran

Strategi Jitu Mahjong Ways untuk Raih Keuntungan Maksimal Tanpa Boong

Mahjong Ways Limited Edition Permainan Terbaik untuk Isi Waktu Luang

Viral Mahjong Ways Gim Seru Penghasil Cuan Usai Kegiatan di DPR

Review Mahjong Ways Pengalaman Main dan Tips Dapat Reward Terbaik

Mahjong Ways Tantangan Baru yang Menghibur dan Menguntungkan Sekali

Eksklusif Main Mahjong Ways Sekarang dan Klaim Hadiah Spesialnya

Bosannya Usai Demo DPR Hilangkan dengan Keseruan Mahjong Ways

Rahasia Mahjong Ways Turnamen Online Berhadiah Fantastis untuk Pemula

Boby Nasution Bongkar Diskotik Marcopolo

Terungkap Boby Nasution Marcopolo

Club Diskotik Marcopolo Dibongkar

Eksklusif Boby Nasution Club Marcopolo

Fakta Tersembunyi Club Marcopolo

Boby Nasution Ungkap Club Marcopolo

Heboh Club Malam Marcopolo

Club Marcopolo Disorot Boby Nasution

Boby Bongkar Club Malam Marcopolo

Boby Nasution Beberkan Isu Marcopolo

Menkominfo Canangkan Pilot Project Transformasi Digital Koperasi 2025

Transformasi Digital Koperasi Dimulai: Pilot Project Resmi Dicanangkan Menkominfo

Era Baru Koperasi: Menkominfo Luncurkan Program Transformasi Digital Perdana

Pilot Project Transformasi Digital Koperasi Diluncurkan Menkominfo, Apa Dampaknya?

Resmi! Menkominfo Mulai Gerakan Transformasi Digital untuk Koperasi Indonesia

Profil Noel: Aktivis Antikorupsi dan Perjuangannya di Indonesia

Kisah Noel Korupsi: Fakta, Kontroversi, dan Perjalanan Aktivisme

Siapa Noel? Mengenal Tokoh yang Lantang Suarakan Antikorupsi

Noel dan Isu Korupsi: Sorotan Publik serta Jejak Pergerakannya

Mengupas Noel Korupsi: Figur, Isu Hangat, dan Pandangan Publik

Fakta Terbaru Kasus Raya Bocah Cacing yang Jadi Sorotan Publik

Kasus Raya Bocah Cacing Kronologi Lengkap dan Update Terkini

Mengupas Kasus Raya Bocah Cacing Apa yang Sebenarnya Terjadi

Viral Kasus Raya Bocah Cacing Berikut Fakta yang Perlu Kamu Tahu

Kasus Raya Bocah Cacing Reaksi Publik dan Tanggapan Pihak Terkait

Update Kasus Raya Bocah Cacing Isu Hangat yang Bikin Heboh

Mengulas Kasus Raya Bocah Cacing Sorotan Media dan Publik

Kasus Raya Bocah Cacing Terbaru Bagaimana Perkembangannya

Kontroversi Kasus Raya Bocah Cacing Fakta vs Opini yang Beredar

Kasus Raya Bocah Cacing Kronologi Fakta dan Analisis Pakar

Gibran Bungkam Saat DPR Naikkan Gaji Publik Bertanya Tanya

Tidak Ada Respon dari Gibran Soal Kenaikan Gaji DPR

Sikap Gibran Saat DPR Naik Gaji Diam Seribu Bahasa

Publik Soroti Gibran yang Tak Komentari Naik Gaji DPR

Gaji DPR Naik Mengapa Gibran Tidak Beri Tanggapan

Diamnya Gibran Saat DPR Naikkan Gaji Jadi Sorotan Netizen

Kenaikan Gaji DPR Tanpa Komentar Gibran Apa Alasannya

Respons Gibran Hilang Saat Isu Kenaikan Gaji DPR Mencuat

Naik Gaji DPR Gibran Pilih Diam Publik Heboh

Isu Gaji DPR Naik Gibran Tak Beri Respon Resmi

Berita

Kasus Ijazah Palsu Jokowi Polda Metro Periksa Roy Suryono

Update Terbaru Kasus Ijazah Palsu Jokowi di Polda Metro

Fakta Baru Roy Suryono di Kasus Ijazah Palsu Jokowi

Polda Metro Usut Kasus Ijazah Palsu Jokowi Roy Suryono Dipanggil

Berita Terkini Kasus Ijazah Palsu Jokowi Roy Suryono

Roy Suryono Diperiksa Terkait Kasus Ijazah Palsu Jokowi

Perkembangan Kasus Ijazah Palsu Jokowi di Polda Metro

Kasus Ijazah Palsu Jokowi Apa Peran Roy Suryono

Polda Metro Bongkar Kasus Ijazah Palsu Jokowi

Kronologi Kasus Ijazah Palsu Jokowi Roy Suryono

journal perbanas

Gaji DPR Naik Berapa Besaran dan Alasan Di Balik Kenaikannya

Pembahasan Terkini Mengapa Gaji DPR dan Tunjangannya Meningkat

Membedah Struktur dan Komponen Kenaikan Gaji Anggota DPR

Gaji DPR vs Rata-Rata UMR Indonesia Begini Hasil Perbandingannya

Ini Rincian Lengkap Gaji dan Tunjangan DPR Pasca Kenaikan Terbaru

Simak Analisis dan Dampak Kenaikan Gaji DPR terhadap APBN

Fakta di Balik Wacana Kenaikan Gaji DPR Prosedur dan Legalitasnya

Berbeda dengan Isu Viral Ini Data Resmi Besaran Gaji Anggota DPR

Tidak Hanya Gaji Pokok Ini Tunjangan Menyertai Kenaikan untuk DPR

Mengulik Komponen Pembayaran untuk Anggota DPR Pasca Revisi

Petualangan Eksklusif di Mahjong Ways Edisi Maxi188 Terbatas

Mahjong Ways Spetakuler Nikmati Sensasi Petualangan Maxi188 Terbaik

Keajaiban Mahjong Ways dalam Edisi Spesial Hanya untuk Anda di Maxi188

Jelajahi Dunia Mahjong Ways dengan Tawaran Eksklusif dan Terbatas Hanya Maxi188

Maxi188 Dapatkan Pengalaman Spetakuler di Mahjong Ways Edisi Terbatas

Kisah Sukses Pemain Maxi188 Raih Prestasi Besar Di Mahjong Ways

Edisi Terbatas Pencapaian Luar Biasa Pemain Maxi188 Di Mahjong Ways

Pemain Maxi188 Torehkan Rekor Unik Di Dunia Mahjong Ways

Mahjong Ways Jadi Ajang Prestasi Pemain Maxi188 Edisi Eksklusif

Inspirasi Dari Pemain Maxi188 Yang Mencetak Pencapaian Fantastis

Edisi Terbatas Petualangan Epik di Dunia Gate Olympus

Rahasia Keindahan Gate Olympus yang Wajib Dijelajahi

Gate Olympus Eksplorasi Mitologi Yunani Edisi Spesial

Kisah Inspiratif dari Negeri Legenda Gate Olympus

Gate Olympus Perjalanan Unik Menuju Puncak Kejayaan

Membongkar Misteri Gate Olympus dalam Edisi Terbatas

Inspirasi Mitologi di Balik Keagungan Gate Olympus

Gate Olympus Kolaborasi Seni Cerita dalam Edisi Spesial

Petualangan Unik di Gerbang Legendaris Olympus

Edisi Eksklusif Gate Olympus dan Cerita yang Menginspirasi

Mahjong Ways 2 Petualangan Baru dengan Desain Eksklusif Hadiah Menarik

Mahjong Ways 2 Sensasi Permainan Klasik dengan Twist Modern

Mahjong Ways 2 Raih Kemenangan dengan Strategi Bonus Spesial

Mahjong Ways 2 Edisi Terbatas dengan Fitur Grafis Memukau

Mahjong Ways 2 Temukan Rahasia Level Baru Kombinasi Langka

Buruh Pabrik Ungkap Pola Tips Mahjong Ways Edisi Terbatas di Maxi188

Rahasia Pola Mahjong Ways dari Buruh Pabrik Rekomendasi Eksklusif Maxi188

Buruh Pabrik Bocorkan Pola Unik Mahjong Ways Limited Edition Maxi188

Pola Strategi Mahjong Ways ala Buruh Pabrik Rilis Spesial Maxi188 2025

Temuan Mengejutkan! Pola Mahjong Ways dari Buruh Pabrik Versi Langka Maxi188

Petualangan Eksklusif di Mahjong Ways Edisi Maxi188 Terbatas

Mahjong Ways Spetakuler Nikmati Sensasi Petualangan Maxi188 Terbaik

Keajaiban Mahjong Ways dalam Edisi Spesial Hanya untuk Anda di Maxi188

Jelajahi Dunia Mahjong Ways dengan Tawaran Eksklusif dan Terbatas Hanya Maxi188

Maxi188 Dapatkan Pengalaman Spetakuler di Mahjong Ways Edisi Terbatas

Kisah Sukses Pemain Maxi188 Raih Prestasi Besar Di Mahjong Ways

Edisi Terbatas Pencapaian Luar Biasa Pemain Maxi188 Di Mahjong Ways

Pemain Maxi188 Torehkan Rekor Unik Di Dunia Mahjong Ways

Mahjong Ways Jadi Ajang Prestasi Pemain Maxi188 Edisi Eksklusif

Inspirasi Dari Pemain Maxi188 Yang Mencetak Pencapaian Fantastis

Edisi Terbatas Petualangan Epik di Dunia Gate Olympus

Rahasia Keindahan Gate Olympus yang Wajib Dijelajahi

Gate Olympus Eksplorasi Mitologi Yunani Edisi Spesial

Kisah Inspiratif dari Negeri Legenda Gate Olympus

Gate Olympus Perjalanan Unik Menuju Puncak Kejayaan

Membongkar Misteri Gate Olympus dalam Edisi Terbatas

Inspirasi Mitologi di Balik Keagungan Gate Olympus

Gate Olympus Kolaborasi Seni Cerita dalam Edisi Spesial

Petualangan Unik di Gerbang Legendaris Olympus

Edisi Eksklusif Gate Olympus dan Cerita yang Menginspirasi

Skip to content

Motorcycle enthusiasts understand the thrill and sense of freedom that comes with riding on two wheels. However, with that exhilaration also comes the responsibility of ensuring adequate protection in case of unforeseen circumstances. State Farm, a well-established insurance provider in the United States, offers motorcycle insurance tailored to the specific needs of riders. In this article, we will explore the details of State Farm motorcycle insurance, including its coverage options, benefits, and why it may be the ideal choice for riders seeking reliable protection on the road.

The Basics of State Farm Motorcycle Insurance

State Farm offers motorcycle insurance policies that cover a wide range of motorcycles, including cruisers, sport bikes, touring bikes, scooters, and more. The coverage options provided by State Farm include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments, and personal injury protection.

Liability Coverage

Liability coverage is designed to protect you in case you are at fault in an accident that causes bodily injury or property damage to others. State Farm provides liability coverage that meets the minimum requirements mandated by each state, helping you comply with legal obligations while riding your motorcycle.

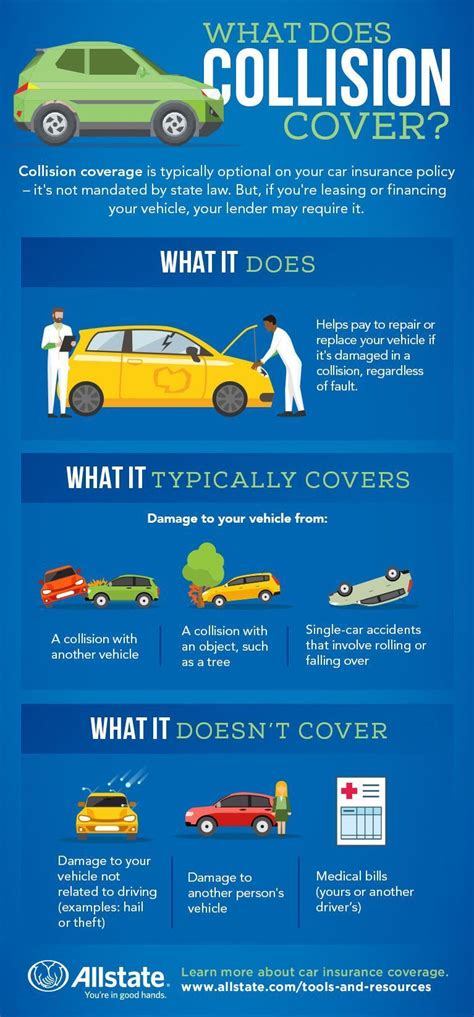

Collision Coverage

Collision coverage helps cover the cost of repairs or replacement of your motorcycle if it is damaged in a collision with another vehicle or object. This coverage ensures that you can get back on the road quickly without having to bear the financial burden of repair costs out of pocket.

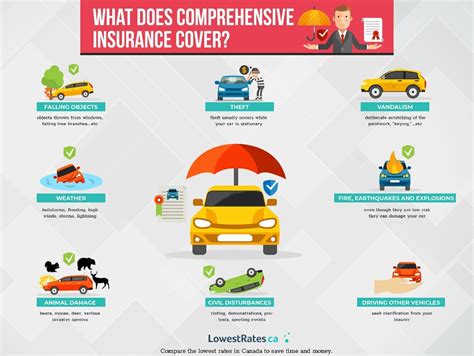

Comprehensive Coverage

Comprehensive coverage protects your motorcycle against non-collision-related incidents such as theft, vandalism, fire, or natural disasters. Having comprehensive coverage in place gives you peace of mind knowing that your bike is safeguarded from various risks.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage steps in to cover your medical expenses and property damage if you are involved in an accident with a driver who lacks insurance or does not have enough insurance to compensate you fully. This coverage ensures that you are protected even when the other party is unable to cover the costs.

Medical Payments and Personal Injury Protection

Medical payments coverage and personal injury protection are designed to cover your medical expenses in case of injuries sustained in a motorcycle accident, regardless of fault. These coverages help ensure that you receive the necessary medical treatment without worrying about the financial impact of healthcare costs.

Benefits of State Farm Motorcycle Insurance

Choosing State Farm for your motorcycle insurance needs comes with a range of benefits that set it apart from other insurance providers. Some of the key advantages of State Farm motorcycle insurance include:

- Personalized Coverage Options: State Farm offers customizable coverage options to tailor your policy to your individual needs and preferences.

- 24/7 Claims Support: State Farm provides round-the-clock claims support to ensure prompt assistance and efficient handling of claims.

- Multi-Policy Discount: By bundling your motorcycle insurance with other State Farm insurance policies, you can take advantage of discounts to save on premiums.

- Rider Training Discounts: State Farm offers discounts to riders who have completed approved motorcycle safety courses, promoting safer riding practices.

Is State Farm Motorcycle Insurance Right for You?

When selecting a motorcycle insurance provider, it’s crucial to assess your individual needs, budget, and preferences. State Farm offers comprehensive coverage options, benefits, and a strong reputation for customer service, making it a popular choice among riders. If you prioritize reliable protection, flexible coverage choices, and excellent customer support, State Farm motorcycle insurance could be the right fit for you.

Conclusion

State Farm motorcycle insurance provides riders with the peace of mind that comes from knowing they are protected while riding. With a variety of coverage options, benefits, and discounts available, State Farm offers personalized solutions to meet the diverse needs of motorcycle enthusiasts. Whether you ride a cruiser, sport bike, or scooter, State Farm has you covered with reliable insurance protection.

Q&A

1. How can I get a quote for State Farm motorcycle insurance?

To obtain a quote for State Farm motorcycle insurance, you can visit the official State Farm website or contact a local State Farm agent. Please enter your details, including information about your motorcycle, riding experience, and coverage preferences, to receive a personalized quote tailored to your specific needs.

2. Are there any discounts available for State Farm motorcycle insurance?

State Farm offers a range of discounts for motorcycle insurance, including multi-policy discounts, rider training discounts, and discounts for anti-theft devices. By taking advantage of these savings opportunities, you can lower your premiums while maintaining comprehensive coverage.