Advertisement

Introduction

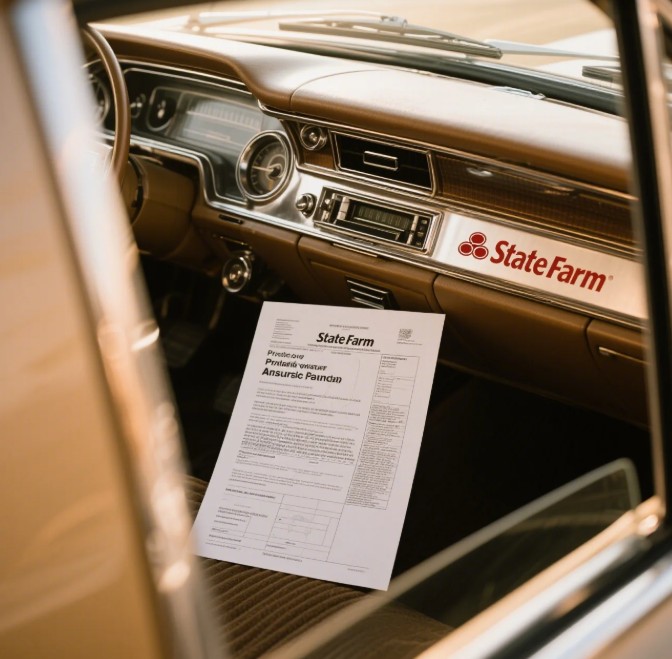

Classic cars are more than just vehicles; they are pieces of history and prized possessions for many enthusiasts. If you’re the owner of a vintage automobile, you understand the importance of protecting your investment. That’s where State Farm Classic Car Insurance comes in. With specialized coverage tailored to the unique needs of classic car owners, State Farm offers peace of mind and financial protection for your valuable vehicle.

What is State Farm Classic Car Insurance?

State Farm Classic Car Insurance is a policy designed specifically for owners of classic, antique, collectible, or vintage vehicles. Unlike standard auto insurance, which typically covers cars for their actual cash value (ACV), classic car insurance considers the agreed-upon value of the vehicle, also known as the stated value. This ensures that in the event of a covered loss, you will receive the full agreed-upon amount without depreciation.

Benefits of State Farm Classic Car Insurance

- Agreed-upon value coverage

- Original replacement parts

- Flexible usage restrictions

- Roadside assistance and towing

- No mileage restrictions

One of the key advantages of State Farm Classic Car Insurance is the agreed-upon value coverage, which ensures that you will be reimbursed the full value of your vehicle in the event of a total loss. Additionally, State Farm allows the use of original replacement parts for repairs, maintaining the authenticity and value of your classic car. Unlike some other insurers, State Farm offers flexible usage restrictions, allowing you to use your vehicle for pleasure drives, shows, and more without strict limitations.

Case Studies

Let’s take a look at a couple of real-life examples of how State Farm Classic Car Insurance has helped classic car owners protect their investments:

Case Study 1: John’s 1965 Ford Mustang

John, a proud owner of a 1965 Ford Mustang, opted for State Farm Classic Car Insurance to insure his beloved vehicle. When John’s Mustang was rear-ended at a car show, causing significant damage, he was relieved to find that State Farm covered the cost of repairs using original parts, ensuring that his Mustang retained its value and authenticity.

Case Study 2: Sarah’s 1957 Chevrolet Bel Air

Sarah inherited a pristine 1957 Chevrolet Bel Air from her grandfather and wanted to make sure it was properly insured. State Farm Classic Car Insurance provided Sarah with agreed-upon value coverage for her Bel Air. When a hailstorm damaged the exterior of the car, State Farm covered the cost of repairs at an authorized restoration shop, preserving the car’s original beauty.

FAQs

1. Can I insure multiple classic cars with State Farm?

Yes, State Farm allows you to insure multiple classic cars under a single policy, simplifying the insurance process for collectors with more than one vintage vehicle.

2. Are there any age restrictions on classic cars eligible for coverage?

State Farm typically considers vehicles over 25 years old to be eligible for classic car insurance, although specific criteria may vary depending on the vehicle’s make and model.

Summary

In conclusion, State Farm Classic Car Insurance offers specialized coverage designed to protect your vintage investment. With benefits such as agreed-upon value coverage, original replacement parts, and flexible usage restrictions, State Farm offers peace of mind for classic car owners. By choosing State Farm, you can rest assured that your prized possession is in good hands.